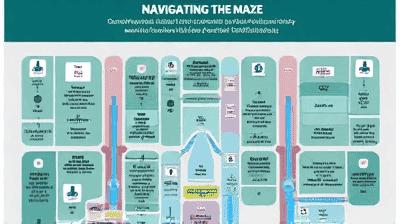

Navigating the Maze: A Comprehensive Guide to Understanding Health Insurance Terminology

- 96,515

Navigating the world of health insurance can be overwhelming. The terminology used can often feel like a different language altogether. Whether you are choosing a new plan, reviewing your current coverage, or trying to understand medical bills, having a solid grasp of the essential terms will empower you to make informed decisions regarding your health and finances. In this comprehensive guide, we aim to demystify common health insurance terminology and provide you with the knowledge you need to navigate the health insurance landscape.

Health insurance is a contract between an individual and an insurance company that provides financial coverage for medical expenses. In exchange for premium payments, the insurance company agrees to pay a portion of healthcare costs as defined in the policy. Health insurance can cover a wide range of services, including doctor visits, hospital stays, preventive care, and prescription medications.

Understanding health insurance terminology is crucial to making informed decisions. Below, we outline some of the most common and important terms you will encounter.

The premium is the amount you pay for your health insurance policy, usually on a monthly basis. It is essential to budget for your premium, as it is the primary cost of having health insurance.

The deductible is the amount you must pay out-of-pocket for healthcare services before your insurance begins to pay. For example, if you have a deductible of 1000 dollars, your insurance will not contribute to your medical costs until you have spent that amount yourself.

A copayment, or copay, is a fixed amount you pay for specific healthcare services at the time of the visit. For instance, you might pay a 30-dollar copayment to see your primary care physician, while a specialist visit may have a higher copayment.

Coinsurance is the percentage of costs you are required to pay after you have met your deductible. For example, if your coinsurance is 20%, and your total bill is 200 dollars, you would pay 40 dollars while your insurance covers the remaining 160 dollars.

The out-of-pocket maximum is the most you will have to spend for covered healthcare services in a given year. Once you reach this limit, your insurance company will pay 100% of covered services for the remainder of the year.

Health insurance plans often have a network of healthcare providers, which includes doctors, hospitals, and specialists that have agreed to provide services at negotiated rates. Staying within your network typically results in lower out-of-pocket costs.

In-network providers are those who participate in your health insurance plan's network. Out-of-network providers do not have a contract with your insurer, which usually means higher costs for patients using their services. It is important to know the difference, as using out-of-network services can significantly increase your medical bills.

Preventive services are health care services designed to help detect and prevent illnesses before they become serious. Many health insurance plans cover preventive services at no additional cost to the patient, including vaccinations, screenings, and annual check-ups.

An HMO is a type of health insurance plan that requires members to choose a primary care physician and get referrals to see specialists. While HMOs typically offer lower premiums, they have less flexibility in choosing healthcare providers.

A PPO is another type of health insurance plan that allows members to see any healthcare provider, in or out of network, without needing a referral. While this plan offers more flexibility, it usually comes with higher premiums and out-of-pocket costs.

An EPO is similar to a PPO, but it does not cover any out-of-network services except in emergencies. This plan typically has lower premiums than PPO plans but requires members to use the network exclusively for non-emergency services.

An HDHP is a health insurance plan with a higher deductible than traditional plans. While these plans have lower premiums, they require individuals to pay a higher amount out-of-pocket before coverage kicks in. HDHPs are often paired with Health Savings Accounts (HSAs) to help save for medical expenses.

An HSA is a tax-advantaged savings account that allows individuals to put aside money for qualified medical expenses. Contributions to an HSA are tax-deductible, and the funds can be used tax-free for eligible healthcare costs.

An FSA is a tax-advantaged account that allows employees to set aside pre-tax dollars for eligible medical expenses. Unlike HSAs, FSAs are not portable and funds typically must be used by the end of the plan year.

An Explanation of Benefits is a statement provided by your health insurance company after you receive medical care. The EOB explains what services were provided, the cost of those services, how much your insurance will pay, and what you owe.

The Annual Enrollment Period is a designated time when individuals can sign up for, change, or cancel their health insurance plans. Outside of this period, changes may only be made under special circumstances, such as a qualifying life event.

A Special Enrollment Period allows individuals to enroll in or change their health insurance plan outside of the Annual Enrollment Period due to qualifying life events, such as marriage, having a baby, or losing other health coverage.

When choosing a health insurance plan, it's essential to consider your healthcare needs, including how often you visit doctors, whether you need prescription medications, and any ongoing medical conditions. Review your cost-sharing responsibilities, provider networks, and coverage options to find a plan that best meets your needs.

Read your policy documents carefully: Understanding your plan's coverage details will help you avoid unexpected costs.

Get familiar with terms and acronyms: Keeping a list of common terms and their definitions can help you feel more confident when discussing your plan with providers.

Reach out to your insurance provider: Don't hesitate to call your insurer with questions about your coverage or specific terms you don't understand.

Review your plan regularly: Your health and healthcare needs may change over time, so periodically reviewing your plan can help ensure you have the right coverage for your situation.

Health insurance terminology can be complex and daunting, but understanding these essential terms can significantly enhance your ability to make informed healthcare decisions. Educating yourself about your options will empower you to navigate your health insurance plan with confidence. Whether you are a first-time buyer or a seasoned policyholder, staying informed is the key to making the most of your health insurance coverage.